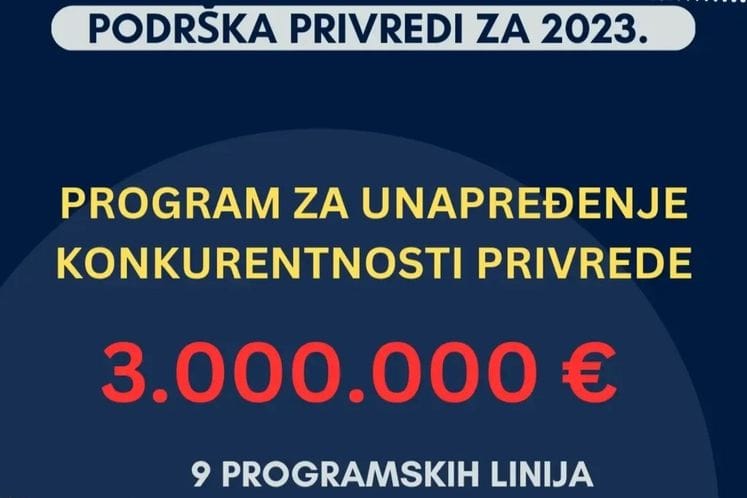

The Ministry of Economic Development and Tourism presented the Program for Improving the Competitiveness of the Economy for 2023

- Details

The Ministry of Economic Development and Tourism of Montenegro invites domestic micro, small and medium-sized enterprises and entrepreneurs to submit an application for participation in the procedure for the allocation of funds for the Program for the Improvement of the Competitiveness of the Economy.

General conditions for participation:

The right to participate in the Program, i.e. program lines, is available to micro, small, medium-sized enterprises and entrepreneurs registered in accordance with the Law on Business Companies ("Official Gazette of Montenegro", number 65/20), the Decree on detailed criteria, conditions and methods of awarding state aid ("Official Gazette of Montenegro", number 27/2010, 34/2011 and 16/14) and the Law on Accounting ("Official Gazette of Montenegro", number 145/21) and which meet the following conditions:

- They operate 100% in private ownership, excluding off shore companies;

- They are based in the territory of Montenegro;

- They are registered in the Central Registry of Business Entities;

- They have the code of the basic activity under which the business entity was registered in the CRPS on December 31, 2022;

- They have submitted official financial statements for 2022 within the legally prescribed deadline or they have been granted an extension of the deadline for submission of financial statements by the Decision of the Revenue and Customs Administration[1].

- For applicants who are not obliged to prepare financial reports, it is necessary that the entrepreneur, who pays taxes and contributions based on actual income or in a lump sum, has submitted the GPPFL form for 2022, or the ZPO form for 2023;

- Regularly fulfill obligations to pay taxes and contributions to personal income, corporate income tax and value added tax, i.e. regularly settle rescheduled tax obligations, in accordance with the Law on rescheduling of tax claims [2] ("Official Gazette of Montenegro", number 83/ 16), the Decree on the conditions for the postponement of the collection of tax and non-tax claims ("Official Gazette of Montenegro", number 57/18) and the Decree on the conditions for the postponement of collection of due tax and non-tax claims ("Official Gazette of the Republic of Montenegro", number 27/2020 , 50/2020, 015/2021)[3];

- For the same activities, they have not used financial assistance from the state and/or local budget or international institutions/programs and other donors in the last 3 years;

- They are not obliged to return illegally received state aid;

- They are not in the process of bankruptcy or liquidation;

- Whose founder and/or responsible person is not in the criminal records of the Ministry of Justice.

- Are not in financial difficulties[4] (in the sense of the General Block Exemption Regulation) in accordance with the rules on granting state aid.

In the event that the company and the founder of the company have a share of more than 20% in the ownership structure of another business entity (related entities), they cannot apply with both companies to the same program line.

Financial framework:

The total budget allocated for the implementation of the Program for the Improvement of the Competitiveness of the Economy is €3 million, while the individual amounts, as well as the manner and dynamics of support allocation, are defined by individual program lines.

Activities not supported by the Program:

The program does not cover activities based on the classification of activities within the following sectors:

Sector A: agriculture, forestry and fishing;

Sector D: supply of electricity, gas, steam and air conditioning

Sector G: wholesale and retail trade and repair of vehicles and motorcycles;

Sector K: financial and insurance activities;

Sector O: state administration and defense and mandatory social insurance;

Sector T: activity of the household as an employer; the activity of households that produce goods and services for their own needs;

Sector U: activities of extraterritorial organizations and bodies.

Within the activities covered by the Program, and the mentioned sectors, it should be noted that the following activities are also excluded from the program line for the purchase of high-value equipment:

Sector I – Accommodation and catering services.

A detailed list of permitted activity codes within the supported sectors is an integral part of the Program Annex.

Within the supported activities, costs related to the construction of ready-made housing and business units, the purchase of passenger/truck/commercial vehicles, as well as the rental/lease of material goods are not subject to co-financing. Also, costs directly related to the production and distribution of products (product manufacturing costs, transport costs, capital investment costs, administration costs, depreciation), insurance, exchange rate differences, payment of arrears, interest, taxes, fees, loan repayment installments, etc., banking costs, commission payments, and similar costs related to the implementation of contracts, payment of commissions, any type of personal expenses, etc., are not covered by this Program.

Documentation obtained ex officio:

The Ministry of Economic Development will, in accordance with the legal form of the applicant's registration, provide the following evidence ex officio:

- Extract from the Central Register of Business Entities;

-Certificate of paid taxes and contributions or rescheduling of obligations, ending with the previous month, in relation to the month of submission of documentation for reimbursement of expenses;

- Confirmation that the founder and/or responsible person is not in the criminal record of the Ministry of Justice.

Regional aspect and classification of LGUs according to the level of development:

For economic entities that are registered and perform activities in local self-government units (LGUs) with a development index of up to 100%, support will be applied that takes into account the regional aspect and the classification of LGU units according to the level of development. The increased percentage of non-refundable support will be defined by each individual program line with business entities operating in the following municipalities: Petnjica, Andrijevica, Gusinje, Plav, Rožaje, Tuzi, Berane, Bijelo Polje, Šavnik Mojkovac, Kolašin, Pljevlja, Plužine, Ulcinj, Bar, Žabljak , Cetinje, Nikšić, Danilovgrad.

The condition is that in the last six months until the date of publication of the Public Call, there were no changes in the ownership structure, as well as in the change of the address of the Company's headquarters within another LGU, which would provide an increased amount of support.

For economic entities operating in local self-government units whose development index is above 100%, there is no increase in the percentage of grant support.

Submission of applications and required documentation:

Application documentation for participation in the Program and individually defined Program lines will be published on the website of the Ministry of Economic Development and Tourism, www.gov.me/mek. Also, all information and professional assistance related to the program lines, application method and necessary documentation can be obtained through the e-mail addresses of the holders of individual program lines and through the contact form on the portal https://biznis.gov.me for each individual line.

Submission of applications and accompanying documentation will be done through the online application at https://programi.gov.me, where user instructions on how to apply will be available, which will also be found on the website of the Ministry of Economic Development and Tourism www.gov. me/mek and https://biznis.gov.me. In case of technical problems in the work of the Platform for submission of applications and requests for refunds, they will be received at the archives of the Ministry of Economic Development and Tourism, which applicants will be informed about on the website www.gov.me/mek.

The deadline for submitting applications/requests by business entities is September 30, 2023 by 3:00 p.m., while the deadline for submitting final reports/requests for reimbursement of approved activities is November 1, 2023 until 3:00 p.m., unless not otherwise defined within the individual Program line.

Application documents:

After choosing the program line (and the corresponding component/s), the applicant proceeds to fill out the electronic forms that form part of the mandatory general documentation for all program lines:

- Application form;

-Statement of the entrepreneur/business company on acceptance of the conditions of the Program;

-Statement on related parties;

- A form confirming that the company is not in financial difficulties in terms of the Regulation on general joint exemption;

After filling out the electronic application form and checking consent on the remaining three electronic forms, the applicant signs and submits consent to all of the above through a special form.

Depending on the program line for which you are applying, additional documentation (offers/invoices/bank statements, etc.), which will also be submitted electronically, is also submitted when submitting the application. Each individual program line defines the necessary additional documentation that must be submitted, as well as the documentation that is required for the refund of funds.

Note:

Submitted offers/pro-invoices/invoices must contain a clearly defined subject of procurement/service, delivery/realization deadline and the price of the product/service expressed in EUR and including VAT (if issued on the territory of Montenegro).

Offers/proforma invoices/invoices issued in a foreign language must be translated into the Montenegrin language and certified by the applicant's company.

Only invoices/contracts issued in the period from January 1 to November 1, 2023 are acceptable, unless otherwise specified by the individual Program line.

All invoices issued by the product/equipment supplier must be paid from the company account of the beneficiary of financial assistance.

Offers, estimates, compensation, cession, factoring and other models of assignment of receivables do not constitute acceptable proof of spending of funds.

The commission reserves the right to reduce the amount of reported expenses for reimbursement if they are not in accordance with justified expenses and defined deadlines, or has the right to reject the request.

The company is obliged to independently select a service provider or equipment supplier for the implementation of the above activity. The service provider/equipment supplier cannot be a natural person, but only a legal person and registered entrepreneurs. Changing service providers/suppliers is not allowed. In the event that the company changes the service provider/supplier after the conclusion of the Co-financing Agreement, it submits a written request to the Ministry of Economic Development and Tourism with supporting documentation on the reasons for the change of service provider/supplier. The Commission reserves the right to decide on the reasons for each individually submitted request.

Business entities (including related parties) can apply for a maximum of three Program lines within the Program, as well as within several components of individual program lines, with the proviso that the business entity and its related party cannot simultaneously be users and service providers/equipment suppliers within the same program lines, except for the Program Line for Internationalization Support.

A business entity cannot simultaneously be a beneficiary of funds under the Program line for supporting small investments and the Program line - Vouchers for women and young people in business, in the same calendar year.

If the verification determines that the application form contains false information or that the attached documentation is not valid and in accordance with the conditions of the Public Call, the business entity will be deprived of the right to participate in Public Calls of the Ministry of Economic Development and Tourism for the next 5 years.

More details about the program lines:

-------------------------------------------------- -------------------------------------------------- -------------------------------------------------- -------------------------------------------------- -------------

[1] Does not apply to the Program Line for Business Beginners

[2] Does not apply to the Program Line for Business Beginners. The verification of the settlement of tax debts will be carried out by the IRF at the moment of the decision on the approval of credit funds and in accordance with the business policy of the IRF.

[3] Taxpayers who have decisions on the redirection of funds to a single account, and the same have not yet been implemented on the taxpayer's analytical records, are considered regular taxpayers.

[4] 1. In the case of a limited liability company if more than half of its registered capital is lost due to accumulated losses. This happens when deducting accumulated losses from reserves (and all other elements that are generally considered part of the company's own funds) results in a negative cumulative amount that exceeds half of the subscribed share capital.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)